Subscription Scams: How Hidden Charges Are Draining Bank Accounts In 2024, subscription scams are on the rise, preying on unsuspecting individuals with hidden fees and unauthorized charges. Common tactics include: Free Trial Traps: Scammers advertise “free trials” for products or services, but fine print enrolls you in expensive recurring payments. Fake Subscription Cancellations: Victims receive […]

Category Archives: Protect Yourself

Protect Your Debit Card: Essential Tips to Keep Your Money Safe Your debit card offers quick and easy access to your money, but it can also be a prime target for fraud. At TruEnergy FCU, we want to help you safeguard your finances and avoid becoming a victim of scams. Follow these essential tips to […]

Beware of Account Takeover Fraud: How Scammers Are Draining Accounts Account takeover fraud is on the rise, and financial institutions are seeing an uptick in these sophisticated scams. This type of fraud happens when a scammer gains access to your account and makes unauthorized transactions. How do they do it? Typically, through phishing scams. Fraudulent […]

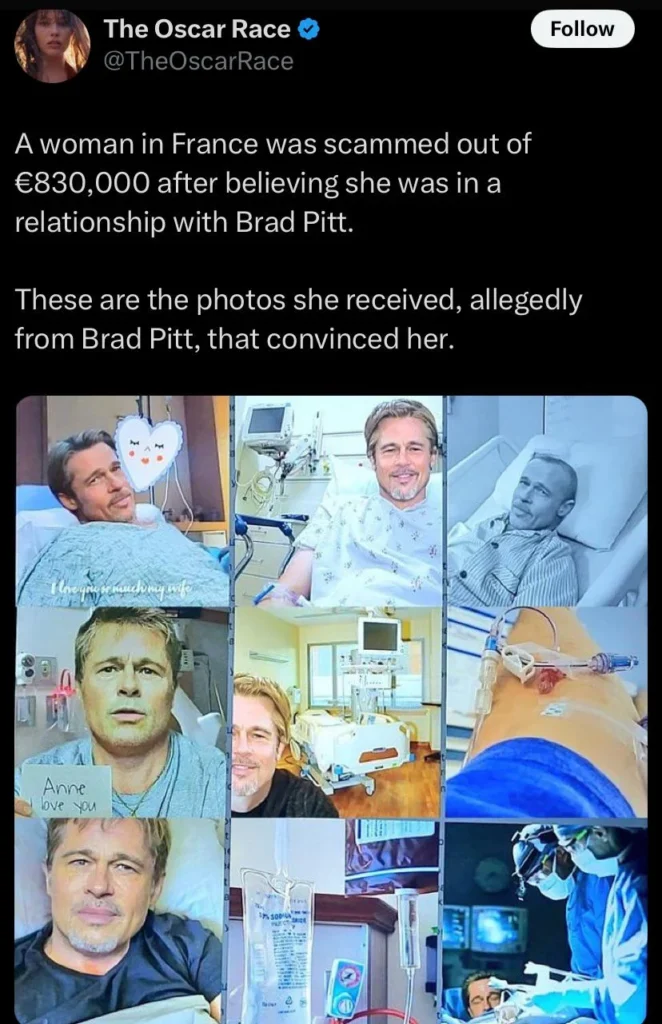

“Too Good to Be True?” Protect Yourself from Celebrity Scams in the AI Era Are you following a celebrity on social media and suddenly…they send you a friend request from another account? In the age of advanced AI, romance scams involving celebrities are becoming more convincing and harder to spot. Fraudsters now use hyper-realistic AI-generated […]

It’s the season of giving. Unfortunately, it’s also the time that scammers take advantage of strangers’ kindness; leading to lost money, stolen identities, and more. Keep an eye out for these all-too-common scams that pop up around the holidays. Package Scams Watch out for emails or text claiming to be from USPS, FedEx, UPS, Amazon, […]

Beware of Gift Card Scams During the Holiday Season As holiday shopping ramps up, be aware of a prevalent scam where fraudsters tamper with retail gift cards, resulting in the loss of funds for unsuspecting victims.

It can be disheartening to see your credit score drop after a financial setback. Whether you missed mortgage payments, made the hard choice to file for bankruptcy or faced something else entirely, these kinds of disruptions can result in a hit to your credit. But with a plan, adhering to healthy financial habits and a […]